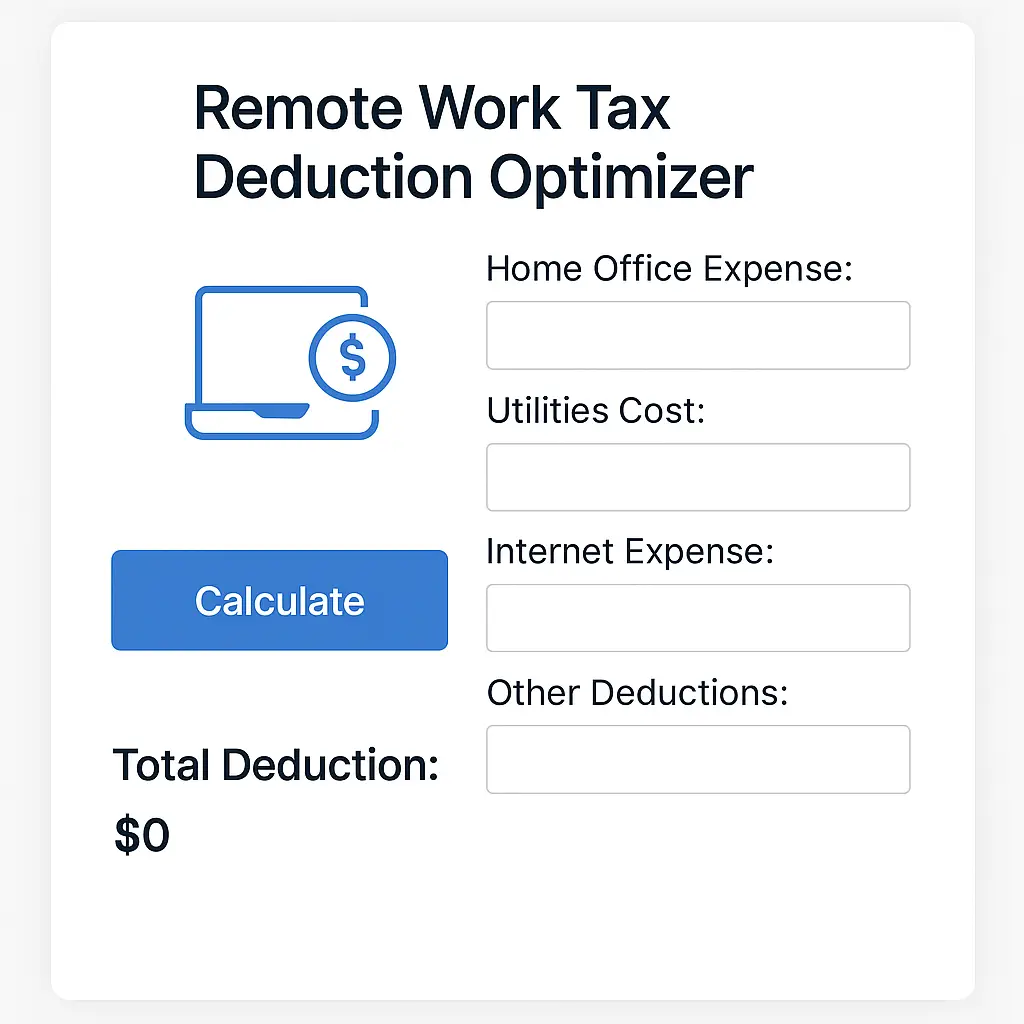

Remote Work Tax Deduction Optimizer

Calculate your potential home office tax savings in just 2 minutes

Your Potential Tax Savings

Calculation Method

Simplified Method: $5 × office sq ft (max 300 sq ft)

Regular Method: (Office sq ft / Home sq ft) × Total home expenses + Direct expenses

The calculator uses whichever method yields higher deductions. Tax savings are calculated by applying your estimated tax rate to the deduction amount.

Share Your Results

Note: This tool provides estimates only. Tax laws vary by location and individual circumstances. The simplified method deduction cannot exceed gross income from business use. Consult a tax professional for specific advice.

The Remote Work Tax Deduction Optimizer is a powerful online tool designed to help remote workers, freelancers, and home-based employees maximize their tax deductions. Whether you're claiming your home office deduction, tracking business expenses, or calculating mileage deductions, this free tax optimization calculator makes it easy. Ideal for self-employed workers, independent contractors, and telecommuters, our tool identifies deductible work-from-home expenses like internet costs, utilities, equipment, and office supplies. With this remote work tax calculator, users can optimize their tax refund, avoid IRS audit triggers, and understand home office eligibility.

This easy-to-use deduction estimator is perfect for filing 1040 Schedule C, handling business use of home calculations, and separating personal vs business expenses. It supports federal tax rules, helps with state tax deductions, and simplifies tax reporting for digital nomads and remote professionals. Use this tool to calculate your standard deduction or maximize your

Frequently Asked Questions - Remote Work Tax Deduction Optimizer

1. What is the Remote Work Tax Deduction Optimizer?

It's a free online tool designed to help remote workers calculate eligible home office and work-related expense deductions for accurate tax filing.

2. Who can use this tax deduction calculator?

Freelancers, independent contractors, gig workers, self-employed professionals, and remote employees can all use this tool to maximize tax savings.

3. Is the Remote Work Tax Deduction Optimizer accurate?

Yes, the calculator follows IRS guidelines and helps estimate tax deductions based on current tax year rules and expense categories.

4. Can I claim internet expenses using this tool?

Absolutely! The calculator allows you to include a percentage of your internet bill used for business purposes when calculating deductions.

5. Does it work with Schedule C filing?

Yes, this tool is ideal for calculating business use of home expenses, which are reported on IRS Form 1040 Schedule C.

6. What type of home office expenses can I include?

You can include rent, utilities, office supplies, repairs, internet, and other eligible expenses related to your work-from-home setup.

7. Is this tool suitable for tax professionals?

Yes, tax professionals can use this calculator to assist clients working remotely or self-employed individuals preparing itemized deductions.

8. Can I estimate both standard and itemized deductions?

The calculator helps determine if itemized deductions from remote work expenses exceed the standard deduction.

9. Is there support for state-specific tax deductions?

While the calculator primarily follows federal IRS rules, it can be used as a reference for state deductions. Check local guidelines for full compliance.

10. Do I need to create an account to use the tool?

No sign-up is required. You can access and use the Remote Work Tax Deduction Optimizer for free, anytime.

11. Can I use this tool for estimating deductions on a shared home office?

Yes, you can input shared expenses and adjust usage percentage to calculate your fair share of tax-deductible amounts.

12. How does the tool handle mileage deductions?

You can input business-related travel miles, and the calculator will estimate deductible mileage based on IRS rates.

13. Will this tool help increase my tax refund?

While not a guarantee, using this tool to track all eligible remote work expenses can significantly increase your chances of a larger tax refund.

14. Is the Remote Work Tax Deduction Optimizer mobile-friendly?

Yes, the calculator is fully responsive and works smoothly on both desktop and mobile devices.

15. How do I save my results?

After using the calculator, you can copy the estimated deduction summary or take a screenshot for your tax filing records.