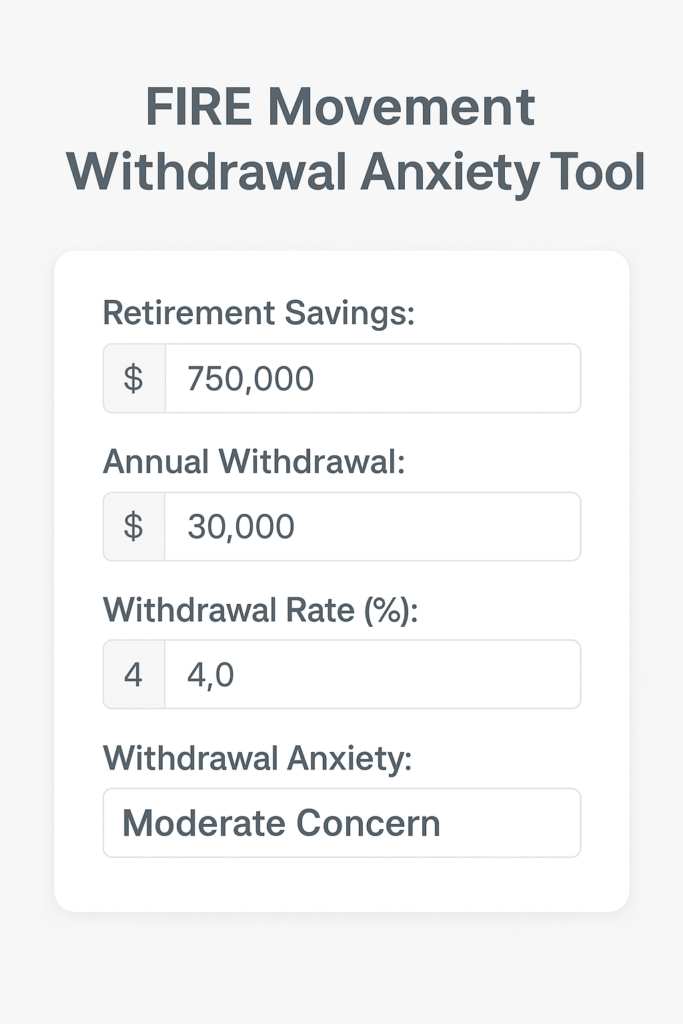

FIRE Withdrawal Anxiety Calculator

Assess your retirement safety margin and reduce financial stress

Portfolio Details

Growth Assumptions

Time Horizon

Your FIRE Withdrawal Safety Analysis

Portfolio Projections

Anxiety-Reducing Strategies

Calculation Method

Monte Carlo Simulation: Models 1000 possible market scenarios based on your asset allocation

Success Rate: Percentage of scenarios where portfolio lasts your lifetime

Years Until Depletion: Average years until portfolio exhaustion in failing scenarios

Share Your Analysis

Important: This calculator provides estimates based on historical market data and your inputs. It does not guarantee future results. The "4% rule" is based on the Trinity Study but may not apply to all situations. Consult a financial advisor before making retirement decisions.

The FIRE Movement Withdrawal Anxiety Tool is a specialized calculator designed to support individuals pursuing Financial Independence Retire Early (FIRE). Whether you're facing early retirement stress, withdrawal strategy planning, or post-retirement money anxiety, this tool offers insights based on your safe withdrawal rate, retirement budget, and investment portfolio. It helps analyze your withdrawal anxiety, early retirement fear, and financial readiness to leave the workforce. Ideal for those concerned about market downturn risks, sequence of returns risk, or cash flow in retirement. It includes factors like emergency funds, lifestyle inflation, passive income support, and long-term investment growth. It empowers users to assess financial independence anxiety, FIRE budget alignment, withdrawal timing, healthcare cost planning, and tax implications of withdrawal. Designed for those using 4% rule FIRE plans, Barista FIRE, or Coast FIRE strategies, this anxiety optimizer gives clarity for retiring early with confidence. It's perfect for financial freedom seekers, minimalists, FIRE bloggers, and early retirees seeking peace of mind. Easily evaluate your financial withdrawal concerns, set realistic retirement expectations, and minimize retirement panic attacks. This calculator supports financial therapy, long-term planning, and mindful FIRE decision-making. Boost your financial confidence, retirement mental preparedness, and overall emotional resilience with this essential FIRE anxiety calculator.

FIRE Movement Withdrawal Anxiety Tool - FAQs

1. What is the FIRE Movement Withdrawal Anxiety Tool?

This tool helps individuals in the FIRE (Financial Independence Retire Early) community analyze and reduce anxiety around withdrawing retirement funds.

2. How does the FIRE anxiety calculator work?

It calculates your financial readiness and helps evaluate risks related to early retirement withdrawals and long-term sustainability.

3. Who should use this withdrawal anxiety tool?

Anyone planning to retire early under the FIRE movement or experiencing anxiety about retirement withdrawals should use this calculator.

4. Can this tool help reduce retirement withdrawal stress?

Yes, it helps you plan safe withdrawal strategies that ease retirement anxiety and promote confidence in financial decisions.

5. Does this tool support 4% rule calculations?

Yes, it integrates the 4% rule to help determine sustainable withdrawal rates for early retirees.

6. What are the benefits of using this FIRE calculator?

It provides clarity on withdrawal timelines, tax impacts, risk tolerance, and emotional readiness for early retirement.

7. Is this tool useful for Barista FIRE or Coast FIRE?

Absolutely. It supports various FIRE strategies including Lean FIRE, Coast FIRE, and Barista FIRE plans.

8. Can this tool forecast long-term investment sustainability?

Yes, it factors in market volatility, sequence of returns risk, and growth rates to project long-term viability.

9. Will this calculator help me manage emotional stress about retiring early?

Yes, it’s designed to support both financial planning and emotional well-being during the FIRE journey.

10. Is the FIRE Movement Withdrawal Anxiety Tool free to use?

Yes, it’s completely free and accessible online for anyone planning early retirement.

11. Can this tool be used with other financial independence planners?

Yes, it's compatible with other budgeting tools, retirement calculators, and investment strategies.

12. Does this tool support healthcare cost projections in early retirement?

Yes, you can include healthcare expenses as part of your overall withdrawal and budgeting analysis.

13. How often should I use this FIRE anxiety tool?

You should use it quarterly or whenever your financial situation, expenses, or retirement goals change.

14. What inputs do I need to use this calculator?

You’ll need your retirement savings, expected annual expenses, projected investment return, and desired withdrawal timeline.

15. Does this tool help with withdrawal tax implications?

Yes, it helps you estimate potential tax burdens during early retirement based on your withdrawal strategy.