Redirecting in 5 seconds...

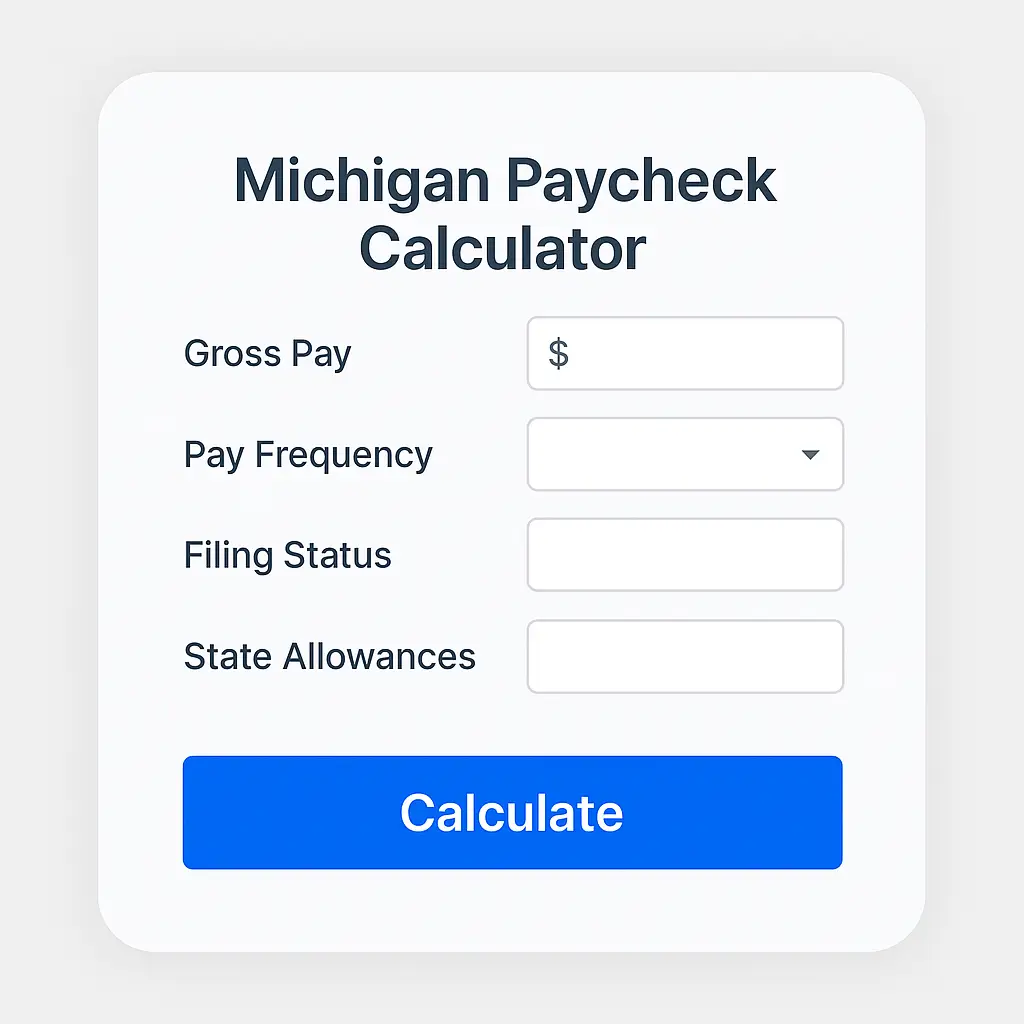

Michigan Paycheck Calculator

Estimate your net take-home pay after Michigan state taxes and other deductions

Your Michigan Paycheck Estimate

Gross Pay

Net Pay

Federal Tax

Michigan Tax

Paycheck Breakdown

Michigan Paycheck Calculation Formulas

Michigan State Tax: Flat 4.25% rate on all taxable income (as of 2023)

Federal Tax: Calculated using IRS tax brackets with allowances applied

FICA Taxes: Social Security (6.2% up to $160,200) and Medicare (1.45%)

Hourly: Gross = Hourly Rate × Hours Worked

Salary: Gross = Annual Salary ÷ Pay Periods

// Michigan Tax Calculation

MI Tax = Gross Pay × 0.0425

// Federal Tax Calculation (simplified)

Taxable Income = Gross Pay – (Federal Allowances × $4,300 ÷ Pay Periods)

Federal Tax = IRS Tax Tables(Taxable Income)

// Net Pay Calculation

Net Pay = Gross Pay – (Federal Tax + MI Tax + FICA + Other Deductions)

Frequently Asked Questions

About Michigan Paycheck Calculator

The Michigan Paycheck Calculator is a powerful tool for employees and employers to estimate accurate take-home pay. Whether you’re paid hourly or salaried, this online paycheck calculator for Michigan helps you calculate net pay, gross pay, and deductions with precision.

It includes all the necessary inputs like Michigan state income tax, federal tax withholding, FICA taxes, and local city taxes. Use this Michigan payroll calculator to calculate your after-tax income, understand your biweekly paycheck, or get insights into Michigan salary breakdowns.

Whether you need a Michigan hourly paycheck calculator, a salary to paycheck estimator, or a paycheck deduction calculator Michigan, this tool provides everything you need. It’s especially helpful for estimating Michigan paycheck after taxes, comparing weekly vs. biweekly pay, and tracking your annual salary impact.

The calculator supports features like overtime pay calculator Michigan, bonus paycheck estimator, and 401k contribution deductions. It also includes health insurance deductions, Medicare withholding, and pre-tax vs post-tax deduction previews.

Ideal for HR professionals and employees alike, this Michigan paycheck estimator supports contractor pay estimates, Michigan tax calculator for paychecks, multi-job income breakdowns, student loan withholding, and net pay comparison tools. Stay on top of your earnings with this all-in-one Michigan payroll deduction calculator and make smarter financial decisions every pay period.